Home

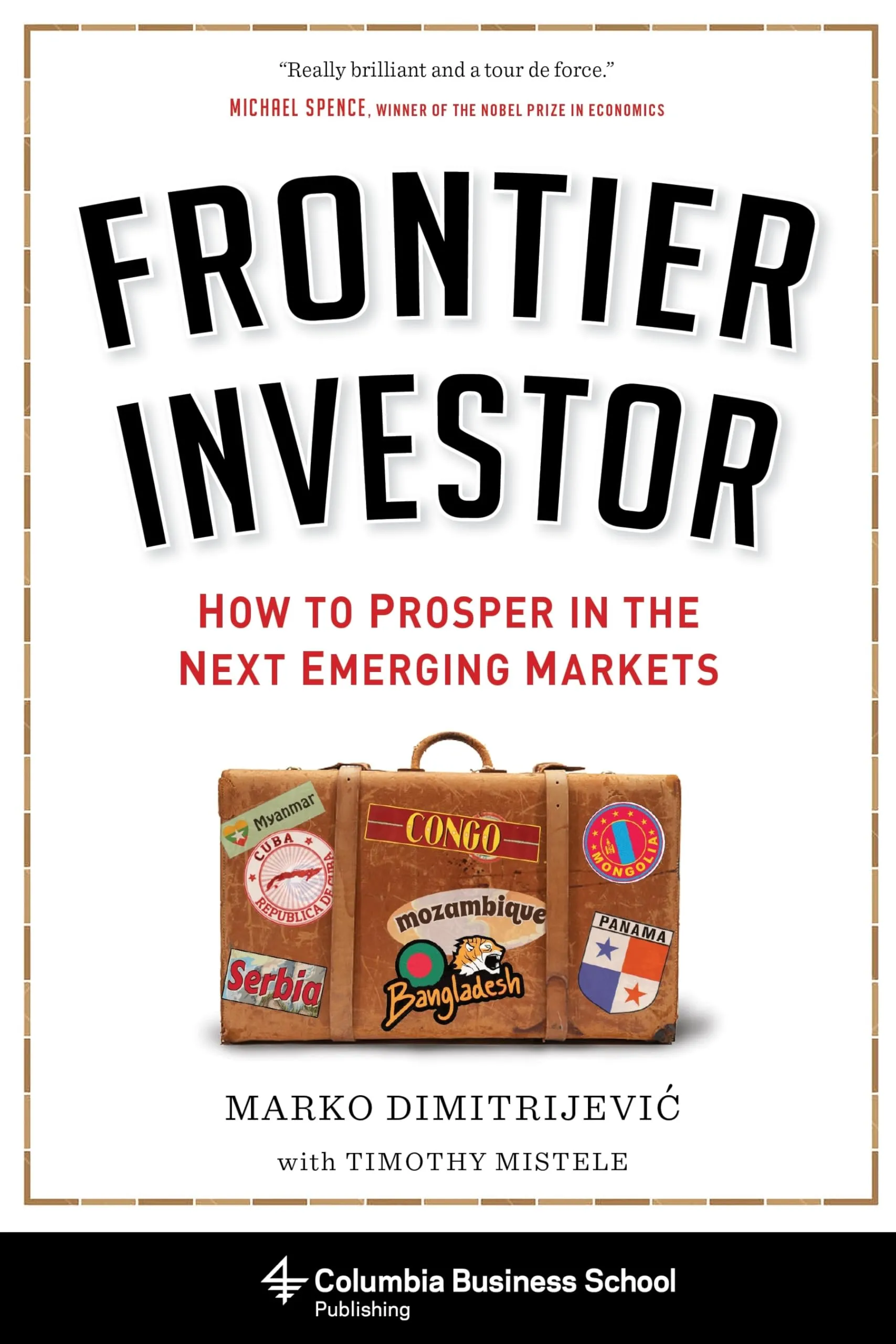

Marko Dimitrijevic Frontier Investor The next great investment opportunities are in Frontier

Now available at Amazon.com, Barnes & Noble, Columbia University Press, and your local independent bookseller.

Step into my world, where compelling narratives, unforgettable characters, and vivid storytelling take center stage.

Michael Spence, PhD, winner of the Nobel Prize in Economics

Marko Dimitrijevic Author of Frontier Investor is one of the world’s foremost emerging markets experts, with over 35 years of professional investing experience. A pioneer in conducting on-the-ground due diligence, particularly in frontier markets, Mr. Dimitrijevic, CFA has traveled to more than 100 countries. He has invested in over 120 emerging or frontier markets, and was one of the earliest Western investors in China, Russia, Indonesia, Bangladesh, and Saudi Arabia. Currently chairman of investment group Volta Global, from 1995 to 2015 he managed one of the world’s best performing emerging markets funds.

"Stories have the power to bridge hearts and inspire change."

Marko Dimitrijevic is one of the world’s foremost emerging markets experts, with over 35 years of professional investing experience. A pioneer in conducting on-the-ground due diligence, particularly in frontier markets, Mr. Dimitrijevic, CFA has traveled to more than 100 countries. He has invested in over 120 emerging or frontier markets, and was one of the earliest Western investors in China, Russia, Indonesia, Bangladesh, and Saudi Arabia. Currently chairman of investment group Volta Global, from 1995 to 2015 he managed one of the world’s best performing emerging markets funds.

"Stories have the power to bridge hearts and inspire change."

Discover how to spot high-potential markets before they become mainstream.

Learn practical methods to invest successfully in emerging economies.

Explore real stories and lessons from over 120 countries worldwide.

Benefit from Marko’s decades of hands-on experience in global investing.

Gain tools to manage the unique challenges of investing in frontier markets.

Discover how to create valuable connections with local experts and businesses.

"I love how easy it is to find quality ebooks here. It's my go-to platform."

Sarah, Book Enthusiast

Years Experience

Countries Visited

Major Industry Awards

Frontier/Emerging Markets

Writing is as much about discovery as it is about creation. Join me as I share the inspirations, research, and experiences that shape my stories. From crafting intricate characters to building immersive worlds, I’ll take you on the journey behind every page.

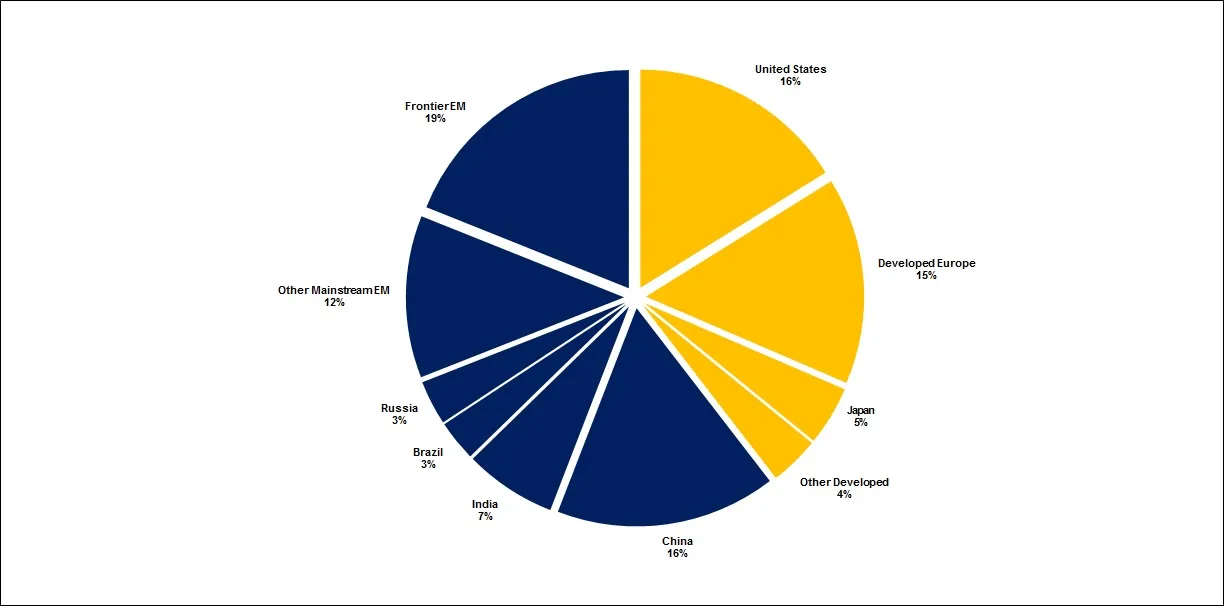

Part One explains why frontier market investments should be in every global investor’s portfolio. It argues that the mainstream emerging markets have emerged, and today’s frontier markets are posed to follow a similar path.

Part Two is a primer on frontier markets investing. It looks at how and where to invest in frontier markets today—directly, if possible, or indirectly, for investors unable to invest in frontier markets but who still want to profit from their growth.

Part Three explores how to navigate the political and other risks of investing in frontier markets, the megatrends that may provide exciting investment opportunities in the coming years, and future opportunities in places beyond the frontier like Cuba and Iran.

Part One explains why frontier market investments should be in every global investor’s portfolio. It argues that the mainstream emerging markets have emerged, and today’s frontier markets are posed to follow a similar path.

Part Two is a primer on frontier markets investing. It looks at how and where to invest in frontier markets today—directly, if possible, or indirectly, for investors unable to invest in frontier markets but who still want to profit from their growth.

Part Three explores how to navigate the political and other risks of investing in frontier markets, the megatrends that may provide exciting investment opportunities in the coming years, and future opportunities in places beyond the frontier like Cuba and Iran.

The Introduction introduces the author, defines what a frontier market is, and gives a road map for the rest of the book.

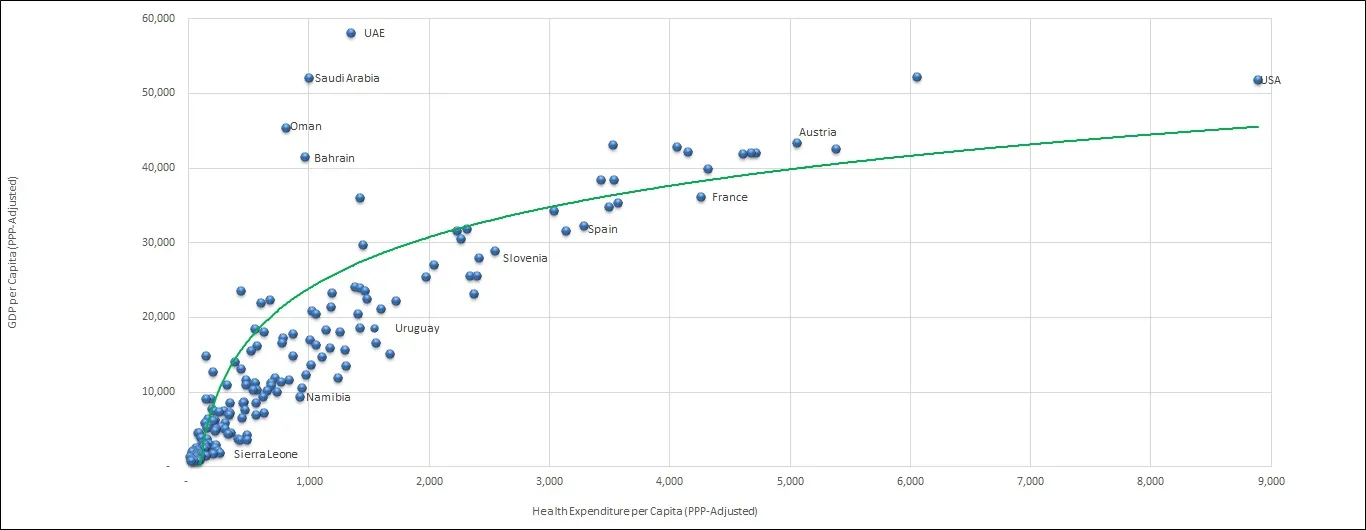

Chapter 1 explains how the traditional distinctions between emerging and developed markets have blurred or disappeared, and the one surviving distinction between them is the price you pay for growth.

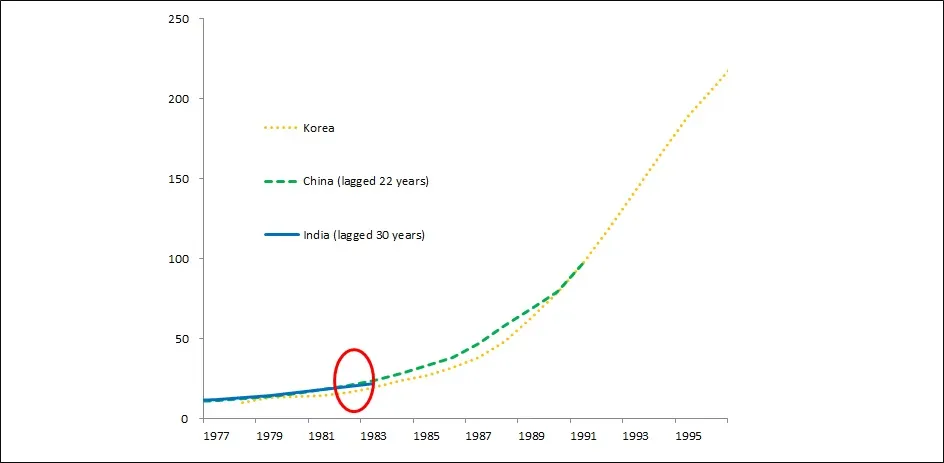

Chapter 2 traces the path of evolution of yesterday’s frontier markets into today’s mainstream emerging markets and describes how today’s frontier markets are on a similar path.

Chapter 3 describes frontier markets’ fast growth and argues that the strong macroeconomic fundamentals of today’s frontier markets will help these markets mimic and accelerate the path to emergence taken by today’s mainstream emerging markets.

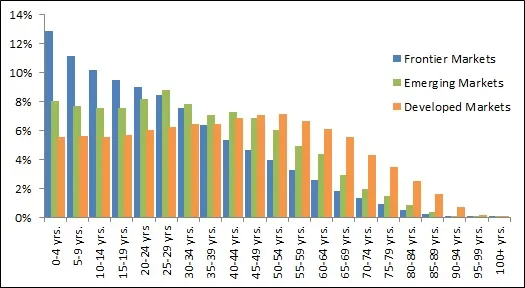

Chapter 4 highlights frontier markets’ favorable demographics—large, young populations—and the one-time demographic dividend of modernization.

Chapter 5 discusses the integration of today’s frontier markets into the global economy and how technology and education in particular will accelerate this integration.

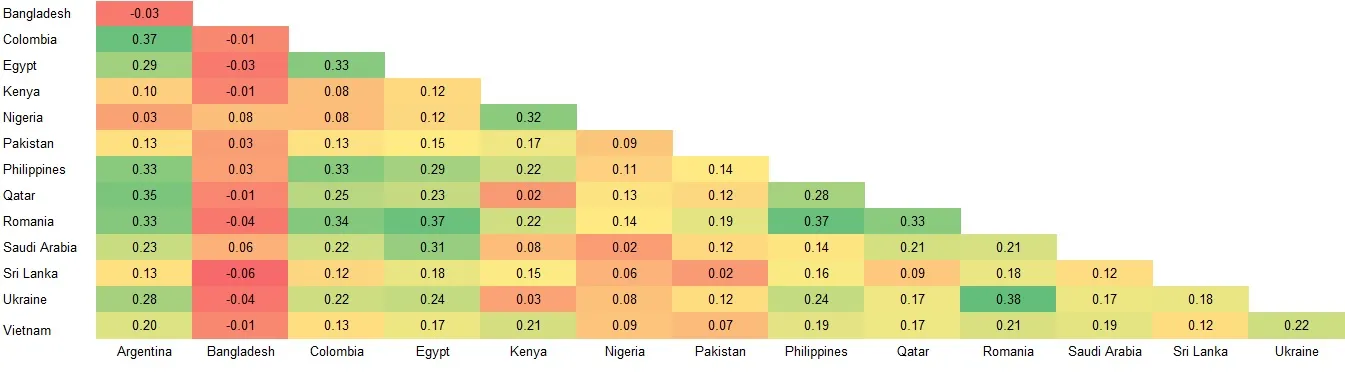

Chapter 6 makes the case for frontier market equities on a valuation basis: they’re cheap, they trade in inefficient markets, and they provide portfolio diversification.

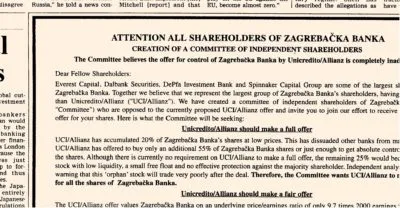

Chapter 7 addresses the pitfalls of passive management of frontier market investments and makes the argument for active, and sometimes activist, frontier markets investing.

Chapter 8 discusses do-it-yourself frontier markets equity investing for self-directed investors.

Chapters 9 addresses investing in special situations in frontier distressed debt.

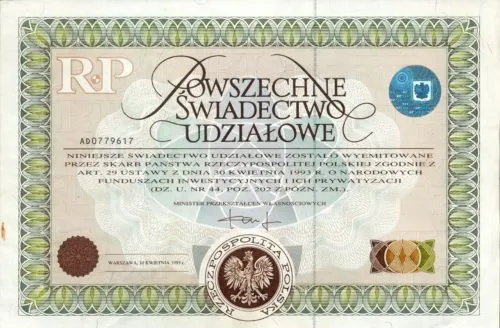

Chapter 10 explores investments in privatizations, from the eastern European voucher programs of the 1990s to current efforts by many frontier markets to privatize state-owned assets.

Chapter 11 looks at the political risks of investing in frontier markets.

Chapter 12 examines the macro- and microeconomic and “headline” risks of investing in frontier markets.

Chapter 13 discusses megatrends that will inevitably drive major changes in frontier markets in the coming years and that may provide exciting investment opportunities.

Chapter 14 ponders the possibility of future investment opportunities on the frontiers of frontier markets—those markets currently closed to outside investors—as well as in places beyond the frontier, such as Cuba, Iran, and North Korea.